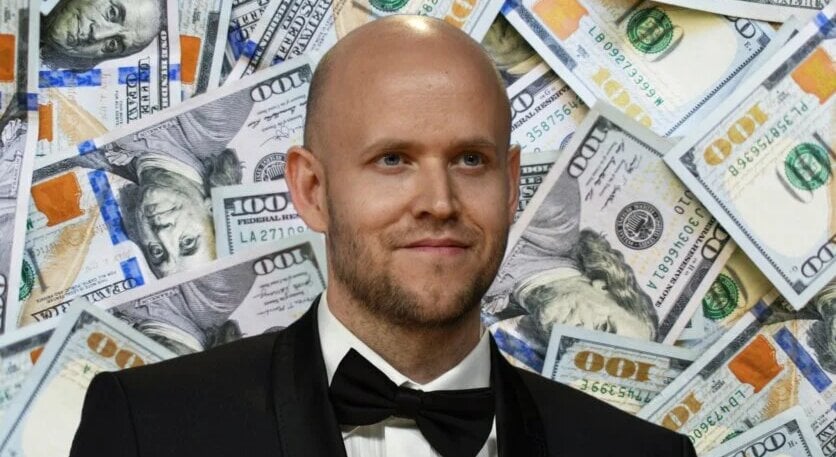

Spotify CEO’s Major Financial Moves

Spotify CEO and co-founder Daniel Ek kicked off 2025 with another significant financial move.

Ek sold more US$27.8 million of the company's share price on Wednesday (January 8), continuing a series of significant stock trades.

Since Ek cashed out a tranche of Spotify shares for the first time in July 2023, he has taken in US$568 million from sales of SPOT shares in total (including the latest transaction), according to MBW calculations.

This week's payout comes as Ek continues to benefit from Spotify‘s rising share price, which reached an all-time high on December 4, 2024, exceeding 500 dollars.

When Spotify listed on the New York Stock Exchange in April 2018, its opening price was $165.90.

According to the new SEC decision innings, as MBW noted, Ek's last deal involved selling 60,000 shares at a market price of $463.93.

The latest transaction occurred just two weeks after Ek cashed out $27.72 million in promotions shortly before the holiday season, on December 23.

These recent transactions cap off a successful year of stock sales for the Spotify CEO, with the total amount of transactions in his 2024 calendar reaching $376 million, according to MBW calculations.

Details of Ek’s Share Sales

Ek's latest stock sale marks the eleventh time since July 2023 that he has cashed out some of his Spotify shares:

- In July 2023, Ek sold 675,000 shares for US$100 million;

- In October 2023, he sold 400,000 shares for $64.2 million;

- In February 2024, Ek sold 250,000 shares for $57.5 million;

- In April 2024, Ek sold 400,000 shares for $118.8 million;

- In November 2024, Ek sold 75,000 shares for $35.8 million;

- In November 2024, Ek sold another 75,000 shares for $34.8 million;

- In November 2024, Ek sold another 75,000 shares for $36.1 million;

- In December 2024, Ek sold another 75,000 shares for $37 million;

- Also in December 2024, Ek sold 60,000 shares for $28.3 million;

- And again in December, Ek sold 60,000 shares for $27.7 million.

Combined with this week's $27.8 million cashing out, that totals $568 million.

However, since July 2017, Ek has opted to forgo a traditional salary, aligning his financial interests directly with the company's market performance.

BIE noted in 2018 that Ek abandoned traditional salaries in favor of a performance-based bonus scheme tied to specific growth metrics.

BIE also tracked the sales of the Spotify co-founder's shares, Martin Lorenzon, which amounted to $556.8 million in 2024. Lorenzon, however, did not sell any shares in December.

As of December 31, 2023, Ek and Lorenzon owned 15.6% and 10.9% of shares in the company, respectively, with voting rights of 30.5% and 42.7% accordingly, based on Spotify's 2023 data in their annual report. Lorenzon also serves on Spotify's board of directors.

These deals indicate the executives' confidence in Spotify's future amid broader industry optimism regarding streaming services’ potential for sustainable profitability, with Spotify maintaining a leading market position in most regions worldwide. The company continues to expand its offerings beyond music, heavily investing in podcasts, audiobooks, and even video, while exploring new revenue streams.

Looking ahead, Spotify plans to announce its fourth-quarter 2024 financial results on February 4th. Management projected quarterly revenue of €4.1 billion euros ($4.2 billion) and an operating profit of 481 million euros for the fourth quarter. If these goals are met, Spotify would achieve annual revenues of approximately 15.5 billion euros and an operating profit of 1.37 billion euros for 2024.

As of Wednesday (January 8), Spotify's share price is $479.73, maintaining a sustainable market capitalization of $96.33 billion.