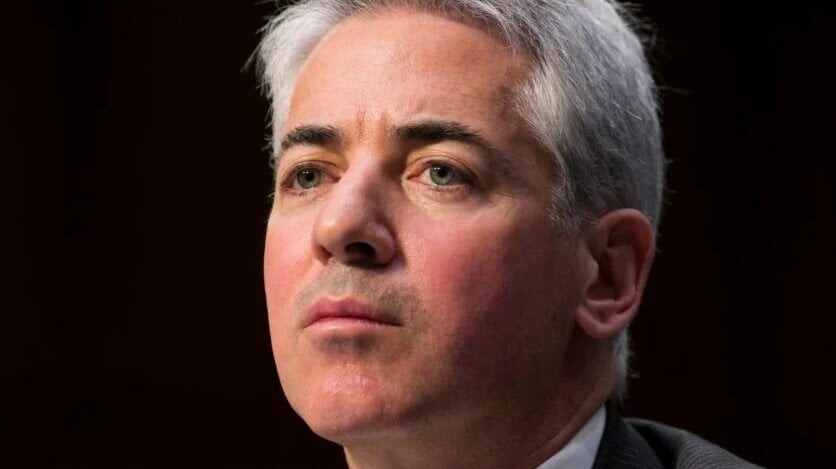

Bill Akman’s Warning About Tariffs

Bill Akman, a millionaire investor and major shareholder of Universal Music Group (UMG), issued a stark warning regarding the global tariffs proposed by US President Donald Trump, describing them as potentially leading to an “economic nuclear winter” if enacted as planned on Wednesday (April 9).

This assessment comes from Akman, a noted Trump supporter, who previously campaigned to relocate UMG‘s financial headquarters and listing from Amsterdam to the United States.

In July of last year, Akman endorsed Trump for the presidency, shortly after being present at a campaign rally where Trump was shot in the ear. Four months later, Akman urged UMG to relocate its domicile and listing to the US, citing “very material benefits.”

According to UMG’s 2024 annual report, Akman, through Pershing Square Holdings, owns 7.48% of the company’s shares, making him the second-largest individual shareholder behind Vincent Bollore.

Concerns Over Trump’s Tariff Policy

On Monday (April 7), Akman released a lengthy statement, expressing support for resolving trade issues but warning that Trump’s approach could devastate businesses and investments.

Last week, Trump introduced a minimum 10% tariff for all countries, a 25% tariff on car imports, and additional “reciprocal” tariffs on nations with which the US has a trade deficit, contending that many countries have long exploited the US due to its trade policies.

“We are in the process of destroying confidence in our country as a trading partner, as a place for doing business, and as a market for investing capital.”

Bill Akman, Pershing Square Holdings

“President @realdonaldtrump raised the tariff issue to the most critical geopolitical matter in the world, capturing everyone’s attention,” Akman remarked. “So far, so good.”

However, Akman’s support soon shifted to criticism as he outlined the possible repercussions of what he termed the “economic nuclear war for every country in the world.” The hedge fund manager cautioned that Trump’s tariff actions would diminish international trust in the US as a trading partner and an investment target.

“By imposing large and disproportionate tariffs on both friends and foes and launching a global economic war against everyone at once, we are undermining confidence in our country as a trading partner, as a business destination, and as an investment market,” Akman articulated.

“When markets collapse, new investments halt, consumers retract their spending, and businesses are left with no choice but to curtail investments and downsize.”

About a month ago, Akman sold part of his shares in UMG. Bloomberg reported that Pershing Square sold 50 million shares of UMG at €26.60 ($29) each, raising a total of €1.33 billion ($1.45 billion).

As of Monday, UMG shares in Amsterdam dropped 2.3% from the previous session to €23.04, marking the lowest level since late November 2024. This decline occurs amidst a widespread sell-off of shares triggered by Trump’s tariff announcements.

“We are heading into a self-induced economic nuclear winter, and we must start to rethink our strategy.”

Bill Akman, Pershing Square Holdings

With a US listing, UMG could shield most of the company’s international revenue from these tariffs, as it primarily earns income from digital and cloud services. UMG’s recorded music subscription revenue in 2024 soared 9.1% to €4.624 billion ($5 billion).

In his statement, Akman urged Trump to implement a 90-day pause before imposing broad tariffs, suggesting that this time-out could facilitate negotiations to resolve “unfair asymmetric tariff practices” and potentially attract “trillions of dollars” in new investments to the US.

“The president has the opportunity on Monday to call for a timeout, allowing for negotiations to address the unfair tariff system,” Akman stated. “Otherwise, we are headed into a self-induced economic nuclear winter, and we must begin to take this seriously.”

He added, “Business relies on trust. The president is losing the confidence of global business leaders… This is not what we voted for.”

Other billionaires have echoed concerns regarding Trump’s tariff measures. Jamie Dimon, CEO of JPMorgan Chase, warned on Monday that tariffs could raise prices and lead to a global economic decline. “Recent tariffs will likely fuel inflation and increase the chance of a recession… regardless of whether the recession is directly caused by them, it will slow growth.”

Even Elon Musk, founder of Tesla and SpaceX, expressed hopes for a “zero-tariff situation” between Europe and the US. “Ultimately, I envision that both Europe and the United States should ideally transition to a zero-tariff environment, effectively creating a free trade zone between Europe and North America,” Musk was quoted as saying.

You can read Bill Akman’s full statement below:

The country is 100% behind the president to correct the global tariff system that has been imposed on us. But business is a game of trust, and trust is built on confidence.

President @realdonaldtrump elevated the tariff issue to the most significant geopolitical challenge globally, capturing everyone’s attention. So far, so good.

Yes, other countries have taken advantage of the United States, shielding their domestic industries at the expense of millions of our jobs and economic growth.

However, by imposing mass and disproportionate tariffs on both allies and adversaries and initiating a global economic war simultaneously, we risk destroying trust in our country as a trading partner, a business hub, and an investment market.

The president has the chance to call for a 90-day timeout, negotiate, and address these unfair asymmetric tariff practices while appealing for trillions of dollars of new investments in our country.

If, conversely, we embark on an economic nuclear confrontation on April 9, investment will be halted, consumers will lock their wallets, and we will severely tarnish our reputation worldwide, which may take years or even decades to mend.

Which CEO or board of directors would feel secure making significant, long-term economic commitments in our country during an economic nuclear war?

I do not know who would take that risk.

When the markets crash, new investments cease, consumers stop spending, and businesses have no option but to cut back on investments and staffing.

These challenges will not only impact large corporations. Small and medium-sized enterprises and entrepreneurs will bear even greater burdens. Hardly any business can withstand a sudden, substantial hike in costs imposed on its customers, even if they are not directly affected, given the multitude of pressures in the system.

Business operates on trust. The president is undermining confidence among business leaders globally. The fallout for our country and for millions of citizens who backed the president, particularly low-income consumers already facing economic strain, will be profoundly negative. This is not what we voted for.

The president has the opportunity to call for a timeout on Monday to allow for rectifying the unfair tariff system.

Otherwise, we are heading into a self-induced economic nuclear winter, and we must start taking this situation seriously.

May local development prevail.