This is one of the most interesting graphs in the music business

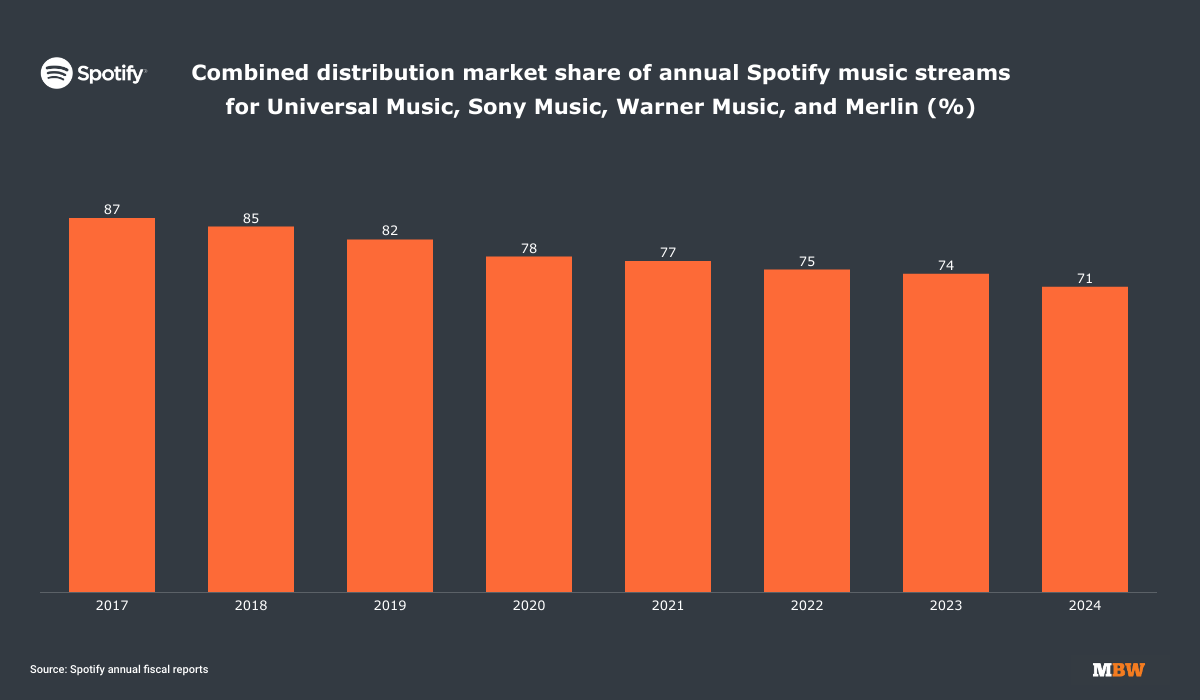

Every year, through its annual 20-F application with the SEC, Spotify reveals the market share (stream volume) of the world’s largest registered music companies on its platform.

Understanding the Data

Before we delve into the details, here are two important points to understand:

- (I) The data presented by Spotify includes all streams of music distributed or represented by three major music companies along with Merlin. This encompasses indie labels distributed by majors and represented in the Spotify Merlin licensing agreements, but does not include indie operators that are Merlin members who negotiate their own Spotify transactions (for example, Distrol and UnitedMasters).

- (II) This figure refers exclusively to the market share of music (excluding audiobooks and podcasts) streamed globally.

Now that we have clarity, here’s the news: in its latest 20-F report, Spotify indicates that the share of content from majors plus Merlin accounted for 71% of all music streams on its service in 2024.

Take a look at how this number has changed over the years:

As illustrated, in 2024, the figure dropped by 300 basis points, reaching 71 percent.

Over the last seven years, this number has decreased by 1600 basis points, down from 87% in 2017, the first year Spotify published this data.

Factors to Consider

Several factors should be analyzed here.

Firstly, the share attributed to Merlin is somewhat ambiguous as it’s difficult to ascertain how many significant Merlin members actually licensed their repertoire directly to Spotify.

For instance, A group of beggars, a major British indie, is known to license directly to TikTok these days, which may also apply to Spotify. Large indies, like them, often grant Merlin the right to license their music to smaller or non-global DSPs, such as Tencent Music or Netease Cloud Music in China, while licensing the larger global DSPs directly themselves.

-… It’s also crucial to remember BMG in this context. Since the end of 2023, BMG severed ties with its licensing and distribution partnership with Spotify, previously managed by Warner Music Group’s Ada (BMG‘s physical distribution partner is now Universal Music Group).

Consequently, the count of majors plus Merlin for Spotify would actually decrease due to the exit of BMG in 2024.

Considering BMG’s size, this would have a significant impact on market share.

In the first half of 2024, BMG announced revenue of 459 million euros (496 million US dollars), with 36%, or around 165 million euros, coming from this business.

Ultimately, what major recording companies truly care about is not the market share volume of streams on Spotify but rather the market share of money paid in royalties.

This is where the so-called “Artist Center” changes will impact their business in 2024.

In the first quarter of last year, Spotify implemented several changes to its royalty structure, including a key update: tracks must now achieve at least 1000 streams in the previous 12 months to generate any registered fees.

Royalties that were previously allocated to the owners of these tracks were not preserved by Spotify; instead, they were redirected to the “Distribution Pot” for tracks that had surpassed 1000 streams.

Thus, when examining the 71% market share of majors plus Merlin in 2024, it’s essential to remember that any tracks included in these market share calculations that did not exceed 1000 annual plays would not be monetized.

Could this potentially benefit the share of major sound recordings in Spotify royalties compared to their stream market share? Almost certainly.

According to the latest Loud and Clear statistics, as of 2023, there were 24.27 million tracks with 5000 lifetime streams.

This accounts for less than a quarter of all music tracks (approximately 100 million) on the platform at that time.

More recently, Luminate reported that at the end of 2024, there were 202 million distinct loaded tracks (ISRCs) on streaming services, and 175.5 million of them were played less than 1000 times last year (across multiple services).

To reiterate: Last year, more than 86% of tracks in streaming services were played less than 1000 times.

Tracks that did not reach 1000 plays on Spotify were also played less than 1000 times across all services combined.

That’s a vast amount of music being played… but not generating revenue.

As explained, the money that was previously allocated to these tracks is now funneled towards more popular music, which predominantly benefits the larger music companies.

Recently, Universal Music Group and Warner Music Group announced new long-term licensing agreements with Spotify.

The core of both announcements emphasizes a commitment to further exploring “artist-focused initiatives” on Spotify in the future.

Sir Lucian Grainge, chairman and CEO of Universal, referred to the term “artist-oriented” in a letter to staff at the beginning of 2023.