Universal Music Group Updates

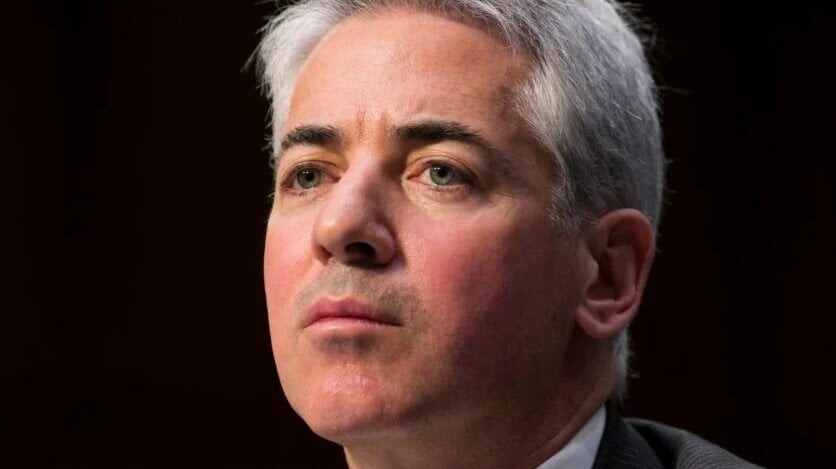

Universal Music Group (UMG) announced on Wednesday (January 15) that Pershing Square Holdings, led by billionaire investor Bill Ackman, has requested a secondary listing of the music company on the US stock exchange.

As per the previously disclosed agreement, UMG will support the underwritten placement of shares, enabling Pershing Square to sell a portion of its shares before September 15, 2025.

The arrangement mandates Pershing to liquidate a minimum of $500 million worth of its UMG holdings as part of the listing procedure.

UMG stated: “Pershing Square has exercised its right under the previously disclosed Registration Rights Agreement between UMG and Pershing to initiate the listing and secondary listing of UMG in the United States.”

“Pershing has waived the 120-day filing requirement, and in line with its contractual commitments, UMG will make commercially reasonable efforts to initiate an underwritten offering to sell certain shares held by Pershing by September 15, 2025, subject to regulatory approval and market conditions.”

Ackman’s Confirmation

Ackman confirmed the development on social media platform X, remarking: “Pershing Square exercised its UMG listing rights to accelerate the company’s U.S. listing. Our registration rights agreement compels Pershing Square to sell $500 million worth of UMG shares (part of a total investment of $3.3 billion in the company) in connection with the US listing, and we will proceed with the sale to facilitate the listing.”

“We opted to list UMG in the US as we believe it will greatly increase demand for (and valuation of) UMG shares from investors mandated to invest in US-listed securities, and will likely attract additional analytical coverage for the company. A US listing will also notably enhance trading liquidity for the stock.”

“We waived the 120 days filing requirement and extended the timeline until mid-September to afford UMG adequate time to finalize the listing and placement in the most advantageous manner for the company and its shareholders.”

“Pershing Square has exercised its right under the previously disclosed Registration Rights Agreement between UMG and Pershing to solicit the listing and secondary listing of UMG in the United States.”

Universal Music Group

This move follows a distribution of shares from Pershing to Square Capital Management, involving 47 million shares equivalent to 2.6% of UMG co-investors of the fund earlier this month.

Post-distribution, Pershing Square retained 140 million shares, translating to 7.6% ownership in Universal.

According to Ackman's statement today, it now seems that Pershing Square intends to sell more than 500 million dollars worth of UMG shares on the US stock exchange.

The push for a US listing comes amid rising tensions in the Amsterdam business landscape.

In November 2024, Ackman announced intentions to relocate Pershing Square and UMG from Amsterdam due to incidents involving local football club Ajax and Maccabi Tel Aviv. Subsequently, Pershing Square delisted its shares from Euronext Amsterdam in December 2023.

At that point, Ackman remarked that the unrest in Amsterdam was a “tipping point” for the decision to delist shares from the city’s exchange.

“Focusing the listing on one exchange, the LSE, and exiting a jurisdiction that fails to safeguard its tourists and minorities aligns both sound business and ethical principles. Additionally, this move can reduce costs and enhance liquidity for shareholders,” Ackman commented.

However, UMG asserted that Pershing Square does not possess the right to compel the music company to become US-domiciled or to withdraw from Euronext Amsterdam.

This latest development signifies another chapter in the company’s relationship with Pershing Square. Ackman’s investment firm has revised its position in UMG multiple times, previously reducing its stake from 10% to 7.48% after UMG denied an earlier request for delisting from Amsterdam, as Reuters reported.

Recently, UMG stated that the final decision regarding any actions beyond contractual obligations will rest with the company’s board of directors, which will evaluate strategies that maximize value for all shareholders.

UMG, home to global artists including Taylor Swift, remains one of the largest music enterprises worldwide. The upcoming US listing could expand its investor base.

BNPP Exan Analyst William Packer has closely monitored UMG and its stock performance for several years.

In a research note released this morning, he predicted a US listing in 2025, suggesting it could offer benefits such as enhanced liquidity and the potential for index inclusion.

Packer anticipates that UMG will maintain its Amsterdam base while pursuing a dual listing strategy.

He remarked: “We expect a US listing in 2025, which could yield benefits in liquidity, index inclusion, etc. While uncertainty prevails at this stage, we foresee a dual listing and the continuation of the Amsterdam location. Being a foreign private issuer, UMG may be exempt from GAAP accounting in specific scenarios.”

Packer noted that UMG shares faced challenges in 2024, lagging behind the media sector as a second-quarter warning incited a reevaluation of the long-term growth potential of subscription streaming.

“While uncertainty remains at this stage, we expect the dual listing and Amsterdam residence to be maintained.”

BNPP Exan

This decline resulted from sluggish volume growth, DSP pricing concerns, and subpar performance of ad-supported streaming on platforms like Meta, TikTok, and short video formats, he stated.

Nevertheless, Packer added: “With expectations reset and the company committed to delivering on its Streaming 2.0 vision, we see the outlook for 2025 improving significantly and consider UMG a pivotal media choice for the coming year.”